What Does “Limited Government” Look Like?

It’s budget time in the US Congress. What needs more money and what can be cut? What is untouchable and what is unnecessary? Can the conservative goal of “limited government” be met? Can the liberal goal of providing a wide safety net be achieved? And what do the legislators’ constituents want?

The perennial partisan stalemate over the size of the federal budget for the coming year is at an impasse. The nebulous concept of “limited government” is raised against a growing list of wants and needs that can only be satisfied by increased borrowing or taxes.

Between March 16th and March 20th, 2023, The Associated Press-NORC Center for Public Affairs Research surveyed 1,081 adults concerning their opinions regarding US government spending. Questions covered the size of the US budget and whether the government was spending the right amount for a list of services. When asked if the US government is spending too much, too little or the right amount, 60% said too much, 16% said too little, and 22% said about the right amount. By this survey, the majority of those interviewed believe government services should be cut.

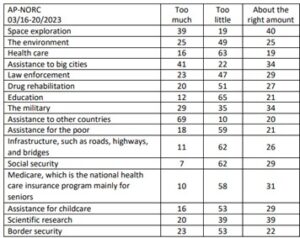

The survey went on to ask where cuts could be made. Of sixteen areas, in only one did a majority of respondents say too much was being spent. That area was assistance to other countries; 69% said too much was being spent. Areas for which a majority said too little was being spent included education, health care, infrastructure, Social Security, and Medicare. When combining the “too little” numbers with the “about the right amount” numbers, little room is left for cutting. (Click on table to enlarge.)

The services provided by federal, state, and local levels permeate every area of support for individuals, families, and businesses with quality education from pre-kindergarten through post-graduate; support for science and innovation; insurance against unemployment, old age, ill health, and poverty; regulation of competition, finance, and money; courts and legal system; protection of intellectual property; infrastructure; political and social stability; protection against foreign enemies, pandemics, natural disasters, and crime; zoning and the use of land; public service news; and management of the economy and public finances.

Is providing all desired services even possible? Social Security long-term solvency could be extended by eliminating the cap on income subject to the payroll tax. Beyond Social Security, the options are raising the debt limit to authorize more borrowing, or raising taxes. The case for raising taxes has been presented in a previous Fifty Year Perspective post. That post reported multiple comparisons among countries, with the US falling behind many EU countries in education, healthcare, income inequality, and poverty. EU countries’ government expenditures are larger relative to GDP and have higher marginal tax rates than the US. And for good measure, the 2023 ranking of the world’s happiest countries ranked seven EU countries happier than the US.