Thomas Piketty on Inequality

A previous blog post described the influence of economists over U.S. fiscal policy, as reported in a book titled The Economists’ Hour by Binyamin Appelbaum. The author described how four decades of applying varying economic theories favored corporations and high income individuals, moving the country from relative equality of income and wealth to inequality, so severe that it threatens the very survival of liberal democracy.

The field of economics has welcomed a new thought leader, French economist Thomas Piketty. Remember that name, because Piketty’s research now resonates throughout the field’s practice, hailed by most economists, but not without his detractors. In 2013 Piketty published in French a book titled Capital in the Twenty-First Century; a 700 page English translation was published in 2014. As of 2017 it had sold 2.2 million copies in 30 languages.

Piketty’s research measured the rate of return on capital in developed countries, and compared it to the rate of economic growth. He concluded that return on capital consistently exceeded the rate of economic growth, and that has caused the current inequality in wealth and will continue to do so in the future. Piketty proposes a Progressive global tax on wealth to effect redistribution.

A 2017 publication, After Piketty: The Agenda for Economics and Inequality, edited by Heather Boushey, J. Bradford Delong & Marshall Steinbaum, is a collection of twenty essays, mostly by economists, two of whom are Nobel laureates, and including essays by professionals in the fields of history, geography, philosophy and sociology. As a group, the essays are a recognition of Piketty’s advancing the study of wealth and inequality.

Nobel laureate Paul Krugman wrote:

… we now know both that the United States has a much more unequal distribution of income than other countries and that much of this difference in outcomes can be attributed directly to government action. European nations … do far more redistribution through taxes and transfers than America does, leading to much less inequality in disposable incomes.

Piketty wrote that events during the first half of the twentieth century played a role in reducing inequality: “it took violent political shocks, wars, and revolutions in order to force Western elites … to accept fiscal and social reforms that they largely refused until World War I.” During the Depression the top Federal income tax rate jumped from 25% in 1931 to 63% in 1932, providing the funding that facilitated a prolonged reduction in inequality.

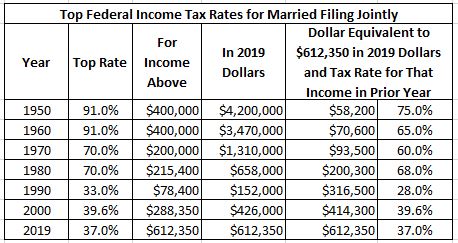

A history of top U.S. Federal income tax rates exhibits levels of taxation that seem astonishing today. The highest income tax rate for “Married Filing Jointly” tax returns was consistently 91% or higher for 20 years, from 1944 to 1963. The table below shows, for ten year intervals over the past 70 years, the top tax rate and the starting income level to which that tax rate was applied.

The purpose of the table is to compare tax rates in past decades for income equivalent to the 2019 top income bracket of $612,350. The fourth column adjusts each prior year’s top income bracket for inflation to equivalent 2019 dollars. The fifth column shows the prior year’s dollar equivalent to $612,350. The last column shows the tax rate in the prior year for that income. For example, a 1950 income of $58,200 was equal to a 2019 income of $612,350; that 1950 couple had a tax rate of 75%, compared to 37% for the 2019 couple.