Good Economy? Bad Economy? Two Answers

That’s the question: Are these good times for the U.S. economy, or bad times? It depends on who you ask, and both answers have backup supporting data.

The Bureau of Economic Analysis (BEA) released change in Gross Domestic Product (GDP) for the fourth quarter of 2021. GDP grew at a healthy 7.0% in the quarter. Quarterly figures had been in the two to three percent range prior to the pandemic. Then the first and second quarters of 2020 registered negative changes of -5.1% and -31.2% respectively. GDP rose in third quarter 2020 by 33.8%, and since then the economy has surpassed pre-pandemic levels, although still short of the pre-pandemic trend.

Unemployment at the beginning of 2020 was 3.5%. By April it had reached its pandemic high of 14.8%. The Bureau of Labor Statistics reported unemployment was down to 3.8% by February 2022. Americans collecting unemployment benefits reached a 52-year low.

In March and April 2020, 22 million jobs were lost. By February 2022, 90% of lost jobs had been restored. Over the same February 2020-February 2022 period average hourly earnings for all employees increased 10.75%, and consumer spending increased.

Despite the favorable direction these statistics are pointing, polling in January 2022 by Gallup found majorities of respondents did not have favorable views of the economy. When asked to rate current economic condition in the country, 40% answered “fair” and 37% answered “poor.” Asked whether economic conditions in the country as a whole were getting better or worse, 67% answered “worse.”

Inflation, currently at a 40-year high, is a major source of anxiety for families at various income levels. The annual inflation rate in the U.S. reached 7.9% in February of 2022. Prior to the pandemic inflation hovered around 2%. Much of the blame for high inflation belongs to three rounds of stimulus checks provided by the federal government in 2020 and 2021 to ease people and business through the pandemic-instigated recession.

A great deal of that stimulus money went to families with children. The child poverty rate increased to 21.4% during the pandemic. Monthly Child Tax Credit payments brought the figure down to 7.6% by March 2021. Following the end of those payments, the monthly child poverty rate escalated in January 2022 to 17%.

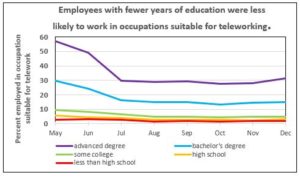

During the pandemic, employees with fewer years of education were less likely to work in occupations suitable for teleworking. They were in and out of work as the pandemic went through a series of lockdowns.

Add rising medical costs, a larger decline in low-wage jobs than middle- and higher-income jobs, loss of high-paying manufacturing jobs, and the general feeling that the recovery has least benefitted the most vulnerable, and the Gallup polling makes more sense. And even in the third year of the pandemic, Covid continues to complicate daily life.

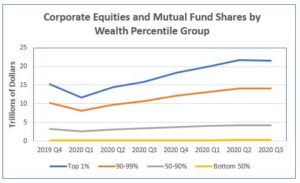

At the other end of the income and wealth spectrum, the pandemic was kind to those with investments in corporate equities and mutual funds. The S&P 500 gained 26.9% in 2021, the Dow Jones Industrial Average gained 18.7%, and the Nasdaq Composite gained 21.4%. The graph below shows the dollar value that each of four wealth groups owned of corporate equities and mutual fund shares from 4th quarter 2019 to 3rd quarter 2021. All four groups’ assets dipped in the 1st quarter of 2021, followed by trillions of dollars of gains for the top 10% wealth percentile.

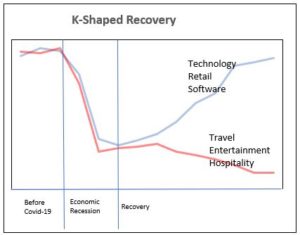

As wealth of some individuals increased sharply, others remain flat or declined. Similarly, some sectors of the economy grew while others declined. The term “K-shaped recovery” came to be used to describe the economy. The graphic produced by Investopedia portrays the divergence. Some industries have recovered quickly while others lag. The divergence also applies to low-income employees in hard-hit sectors experiencing slower recovery.

A September 2021 article from Investopedia foresees troubling long-term implications of the K-shaped recovery: “long-term unemployment among people in the lowest income quintile, wealth inequality, a continuing and worsening racial wealth gap, and growing corporate monopolies.”

So, to answer the question, good economy, bad economy? An economy that progressively enlarges the wealth gap is ultimately unsustainable. Health and social welfare problems increase, as does child poverty. Social cohesion, in terms of civic involvement and mutual trust decreases. Crime increases. Social mobility is reduced. Human capital is underutilized. And the sum of these conditions is also bad for business and the economy generally, by placing goods and services beyond the reach of ever larger segments of the population.

That is not just a matter of who you ask.