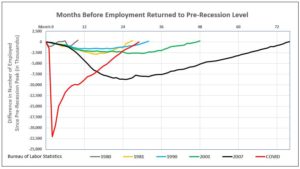

Employment Back to Pre-recession Level After 29 Months

As of July 2022, the number of employed persons in the U.S. had fully recovered to the level of February 2020, the beginning of the recession triggered by the Covid-19 pandemic. Compared to recessions of 1990, 2001, and 2007, the recovery was quick, especially in view of the 22 million jobs lost, compared to 8.7 million lost jobs in the 2007 recession, 2.6 million in 2001, and 1.6 million in 1990. The comparison is strikingly represented by the graph below.

(Click to enlarge graph)

Most major employment categories have surpassed pre-pandemic levels. Exceptions are leisure and hospitality, remaining 1.2 million jobs below pre-pandemic levels, health care 130,000 jobs below, and government 600,000 jobs below. By contrast, professional and business services are almost a million jobs above the pre-pandemic level.

If annual employment since December 2019 continued to increase at the average annual rate of the previous 20 years, current employment would be 2.2 million higher than it was in July. The shortfall could be due in part to workers taking early retirement. Or there could be people who plan to return to the workforce but have not been able to find childcare or caretakers for elderly or disabled family. Or workers who quit their jobs may still be looking for a new job that better fits their lives and financial needs. There are plenty jobs available, nearly two job openings for every unemployed person. Before the pandemic there were always more unemployed people than available jobs.

Looking beyond Bureau of Labor Statistics data, immigration provides another perspective on employee shortfall. Net immigration (the number of arrivals minus the number of departures) has been falling since 2017. A recent study by the University of California, Davis estimated that “by February America was missing roughly 1.8m working-age foreign migrants relative to its post-2010 trend.” Consistent with the slow jobs recovery in the leisure and hospitality sector, the study notes that the sector “draws a quarter of its employees from the foreign-born population” One-fifth of employees in the professional and business services sector are foreign-born; last year that sector was unable to fill 10% of its vacant jobs.

The Pew Research Centre calculates the long-term impact of the fall in migration: “without new arrivals America’s labour force would decline to 163m in 2040 from 166m in 2020. If net immigration were to return to pre-pandemic levels, the labour force would instead grow to 178m by 2040.” The effect on the U.S. economy would be enormous.