A Debt Reduction Plan

In “Reviving the American Dream,” several positive signs of progress toward avoiding recession were highlighted. Constructive assessments by liberal and conservative think tanks concurred regarding economic goals and what is necessary to achieve them: promoting job creation and supporting strong families is shared by conservative and liberal sources alike.

As with the key legislative packages of the first two years of the Biden administration – Infrastructure Investment and Jobs Act, Safer Communities Act, and CHIPS and Science Act – achieving those goals come with big price tags. A recent paper produced by the Peter G. Peterson Foundation, a nonpartisan organization dedicated to addressing America’s long-term fiscal challenges, is titled “The Debt Crisis Is Here.” The paper addresses three prerequisites to reducing the growth of the national debt: save Social Security, reform Medicare, and implement tax reform.

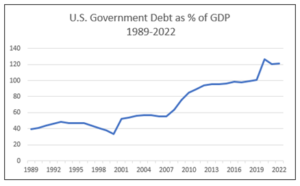

The Foundation recommends the establishment of a Bipartisan Congressional Committee on Fiscal Responsibility. The U.S. debt-to-GDP ratio has surpassed 120%; that is, the total U.S. national debt is 20% greater than U.S. Gross Domestic Product, the total value of goods produced and services provided in the country during one year. The strategic objective of the Commission would be to reduce the U.S. debt-to-GDP ratio to 70%.

Why 70%? “The debt-to-GDP ratio of 70% is a recognized stable level for advanced economies, which shows the burden of debt relative to the country’s total economic output and therefore its ability to repay it.” As illustrated on the chart, the debt-to-GDP ratio over the last decades of the 20th Century was around 40%. Achieving the 70% objective “would require a substantial realignment of fiscal policy and a multi-decade plan.”

stable level for advanced economies, which shows the burden of debt relative to the country’s total economic output and therefore its ability to repay it.” As illustrated on the chart, the debt-to-GDP ratio over the last decades of the 20th Century was around 40%. Achieving the 70% objective “would require a substantial realignment of fiscal policy and a multi-decade plan.”

Various scenarios of tax rate hikes and cost cuts were analyzed to push the ratio to 70% or lower within 10, 20, and 30 years. Doing so by only raising taxes proved unfeasible because that would consume private investment capacity and allow interest on the debt to continue rising. Only cutting outlays would necessitate annual cuts of 22%, an unacceptable level. Achieving the objective 70% in 10 years would induce a major recession. “A combination of raising all taxes by 1.5% permanently, and a reduction in outlays of 8.2% (including spending cuts and interest cost reductions as a result of lower debt) would achieve the goal of debt-to-GDP to 70% in about 20 years.”

To save Social Security, recommendations included raising the maximum income subject to the payroll tax; use a more accurate calculation for cost-of-living increases; gradually raise the age for social Security benefits to 69; remove disincentives for retirees to return to the workforce; cover newly hired state and local workers under Social Security; and diversify Social Security Trust Funds investments from Treasury bills.

To reform Medicare, proposals included allowing consumer choice among competing private healthcare plans; eliminate Medicare Advantage price benchmarks to remove inflation-prone, inefficient fee-for-service costs; raise the age of eligibility; and restrict states’ use of provider taxes to finance Medicare.

Proposed reforms to tax policy included paring back the use of preferential tax breaks; tax capital gains and dividends as ordinary income; end the Alternative minimum Tax and itemized deductions; tax state and municipal bonds; tax exclusions at higher income levels for health insurance benefits, retirement accounts, charitable giving, and mortgage interest; eliminate other tax loopholes, corporate tax subsidies, and deductions.

The Peterson Foundation paper notes that the nation has never experienced the debt explosion that has occurred since 1981, years generally characterized by peace. “Public debt diverts investment dollars away from the private sector and toward U.S. Treasury bonds,” slowing economic growth and lowering living standards. A 20-year commitment to a debt reduction plan is hard to imagine in the current Congress. Although business and the American public support establishment of a bipartisan congressional commission on fiscal responsibility, as with gun control and abortion, policies favored by public opinion fall to the obstruction of a minority.