Inequality and Tax Policy

Two recent blog posts reviewed the impact of government action on inequality and the medical, educational and life expectancy disadvantages experienced by people falling behind economically. While government policy over four decades favored corporations and high income individuals, middle class income remained relatively stagnant, and lower incomes have correlated to lower educational attainment, poor medical conditions and lower life expectancy.

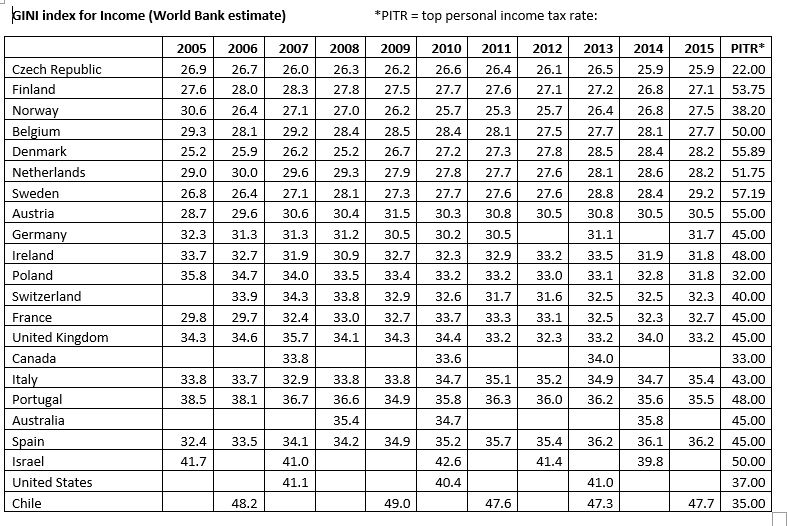

The resulting level of inequality places the United States well behind other democracies. The table below lists 22 democracies with at least five million population, a democracy index above 5.00 on a scale with 10.00 being most democratic, and a corruption index above 50 where 100 is least corrupt. The table is sorted with Czech Republic, the country with the best score for income distribution, the most common measurement of income equality, at the top. The statistical measure is called the Gini index or Gini coefficient. The lower the index, the more equal is the country’s distribution of income. (Japan met the criteria listed above but did not have Gini index data available.)

The table follows the ten year trend for the Gini index from 2005 to 2015, the most recent year for near-complete data. Czech Republic, Finland, Poland and Israel improved over the decade, recording their lowest inequality scores in the last two years of measurement. Denmark, Sweden, Austria, France and Spain recorded their lowest inequality scores in the first two years, although Denmark, Sweden and Austria still held relatively low scores in 2015. Highest levels of inequality in 2015 were in Spain, Israel, the United States and Chile.

In the far right column the table also records another measure relevant to inequality. It is the top personal income tax rate (PITR) for each country in 2019. Generally, higher top tax rates are associated with less inequality. (Czech Republic is an exception.) Finland, Belgium, Denmark, Netherlands and Sweden have top tax rates above 50% and Gini index below 30. The Gini index for the United States, 41.0 in 2013, increased to 41.5 in 2016, and the U.S. has one of the lowest top tax rates.

Economist Heather Boushey has written a new book on inequality titled Unbound: How Inequality Constricts Our Economy and What We Can Do About It. Her argument, and that of many other economists, is that inequality places limits on economic growth in a number of ways: unequal access to education and skill acquisition, and insufficient investment in public goods and services, among others.

This theme was addressed in depth in an article in the January/February 2020 issue of Foreign Affairs. In Why Capitalism’s Salvation Depends on Taxation, economist Joseph Stiglitz and others state the obvious: “It takes money to build roads and ports, to provide education for the young and health care for the sick, to finance the basic research that is the wellspring of all progress, and to staff the bureaucracies that keep societies and economies in motion.” The authors contend that a far more progressive tax code is required to provide the necessary level of revenue to avoid the distortions of inequality.